| SPECS & Features | |

| What's New? |

Despite phone makers flooding the market with cheap devices, Chinese company Oppo believes there’s potential in higher-end handsets, even in emerging markets. Chinese phone maker Oppo may not have the global brand recognition of its compatriot Xiaomi, but the company is working on it. Oppo recently held the launch event for its new N3 and R5 smartphones in Singapore, flying in partners, distributors and journalists from 16 different markets. It’s a different approach from the Oppo Find 7 launch earlier this year, when the company invited journalists to Beijing. It’s certainly more expensive too, but Oppo appears to be rolling in cash at the moment, thanks to its audio equipment business and strong smartphone market presence in China. Oppo’s spending all that cash for a very good reason. With Samsung’s profits and revenue plunging, and Chinese competitors such as Lenovo and Xiaomi ranking third and fourth in global market share, Oppo has the opportunity to step up its game. But unlike the other Chinese manufacturers, Oppo is focusing its efforts on the mid-to-high segment and eschewing the low-cost approach that has made Xiaomi, for instance, so popular. “I would say that our Oppo products from mid to high range are well received by consumers in the market in China. For the RMB2000 to RMB3000 ($327 to $490) price range our market share is 25 percent while for the RMB1500 to RMB2000 ($245 to $327) price range, we’re at 15 percent,” says Sky Li, Oppo’s vice president of the mobile division. “So you see, we do not really specifically focus on our market share, but rather, how do we expand our customer base through our exceptional products and the consumer decides to stay with our brand.” Going forward, Oppo, like other brands, is looking at developing markets as the next battleground for growth. “If you look at the smartphone industry, developed markets such as Europe and America, yes no doubt, we have seen rapid growth, but we have come to see these developed markets have reached market saturation,” says Li. Instead, Oppo is looking towards emerging markets as the next battleground — the company cites compound growth figures of 30 percent for the last five years in Southeast Asia, South Asia, Africa and the Middle East. “If you look at the smartphone industry, it’s not about which market has been growing the fastest,” says Li. “I would say Southeast Asia has been growing rapidly, in particularly Indonesia, which has seen rapid growth.” And that’s also a reason why Oppo chose Singapore to play host to its recent N3 and R5 launch. “In terms of our global expansion strategy, Southeast Asia is our first stop to go international, and because we chose Singapore to host our launch event, it shows we actually attach great importance to the SEA market, though other markets such as South Africa, Africa and Middle East are still important to us,” says Li. As for plans to integrate the company’s audio products and technology into its mobile phones, there are none just yet. That’s something Oppo really needs to look at — if it’s capable of putting its established audio-visual branding and technology on its smartphones, then it’s something that will make its phones stand out even more, especially when compared to the other Chinese manufacturers with their price advantage. (Visited 38 times, 1 visits today)

|

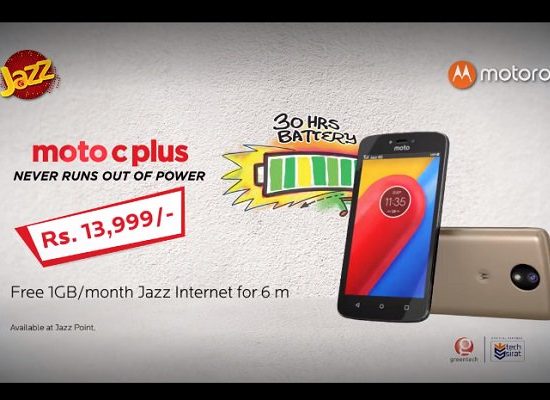

Today's Prices

The Mobile Phone Prices / price list is updated on daily basis from local Mobile shops & Mobile dealers in Pakistan. However we cannot guarantee that mobile prices / price list on this page is 100% correct (Human error is possible). Always visit your local shop/market for getting latest/ exact mobile phone prices.

No comments!

There are no comments yet, but you can be first to comment this article.